Canada’s proposed Artist Resale Rights bill is a Trojan Horse…” to avoid the extra adjective (the) and tighten the opening rhythm.

Canada’s 2025 federal budget introduced an Artist’s Resale Right, a policy intended to grant creators a five percent royalty fee on every future sale of their work. The proposal has been marketed as long-overdue fairness, a corrective meant to help artists participate in the rising value of their own creations. On paper, the idea feels noble. In practice, the effects are far more complicated than the headline suggests.

ARR transforms a resale into something larger than a simple exchange between two parties. A resale becomes a recorded financial event that triggers a royalty obligation. That royalty is then treated as taxable income for the artist. At the same time, the resale itself becomes a taxable, traceable moment in the artwork’s lifespan. The artist receives a payment, the government records a transaction, and the asset becomes more visible within the financial system. What appears to be a small administrative detail is actually a structural shift in how art circulates.

The core of ARR lies in the mechanism that governs every resale. When a work is sold on the secondary market, the buyer pays the agreed price. A percentage of that price is diverted as a royalty owed to the artist or the estate. The artist must declare that royalty as income, and the resale is documented as a taxable event for the government. No transfer can occur quietly. Each sale creates a financial footprint that cannot be erased. As a result, the government benefits twice. It collects new taxable revenue, and it gains a clearer view of where high-value art resides, how it moves, and how much it is worth.

This structure also reshapes behavior. Under the old system, some collectors and intermediaries engaged in strategic resales to inflate an artwork’s value. A painting could move between shell companies or trusted associates, generating a series of “record” prices that created the illusion of rising demand. ARR makes such practices expensive. Each artificial resale requires a royalty payment and triggers a taxable event. The economic friction discourages the inflation loop. Price manipulation becomes a costly habit rather than a profitable strategy.

Supporters of ARR emphasize fairness. They argue that artists deserve a share of the long-term value generated by their work. Historically, a painting could sell for a modest sum early in an artist’s career and then appreciate dramatically later on, enriching dealers, collectors, and estates while the creator received nothing. ARR attempts to correct this imbalance. For certain artists, especially those whose work circulates actively in the secondary market, the additional income could provide meaningful support.

The concerns arise when the financial implications are examined more closely. A royalty functions as a fee added to every future sale. The artist receives the payment but must pay taxes on it. A single resale becomes a dual tax event. Buyers may hesitate to acquire works that carry perpetual obligations. Some may shift toward assets without recurring royalties. And as lifetime costs become part of the purchasing calculation, initial prices may rise to absorb future expenses. Ironically, a system designed to help artists can end up pushing their primary market prices higher, making their work less accessible to new collectors.

There is also the issue of transparency. Governments dislike opaque markets because opacity hides financial activity. ARR makes valuable artworks visible in ways they were not before. Every resale is documented. Every price becomes part of a traceable chain. Every movement of the artwork leaves a digital shadow. For honest collectors, this visibility is benign. For those who use art to store wealth discreetly, obscure transactions, or move funds covertly, this evolution is inconvenient. The painting becomes a kind of Trojan Horse. It enters a private home, a vault, or a freeport carrying not only ideas and emotion but a permanent record of ownership, value, and movement.

Yet ARR is not without potential benefits. It can stabilize artist incomes, deter fraudulent pricing schemes, and limit opportunities for laundering. It brings a measure of honesty to a market that often thrives on ambiguity. But the price of this honesty is structural change. Paintings behave less like free-floating cultural objects and more like semi-regulated assets with embedded obligations. Collectors may adapt. Gallerists may struggle. Artists may gain a small but steady income stream, yet also find their primary market shifting around them in unpredictable ways.

The larger question is not whether ARR is fair, but what it transforms. It promises to reward artists, yet it also pulls art deeper into the architecture of fiscal transparency. It speaks the language of equity, yet creates new layers of cost. It aims to correct a cultural imbalance, yet inadvertently alters how art is bought, sold, held, and perceived.

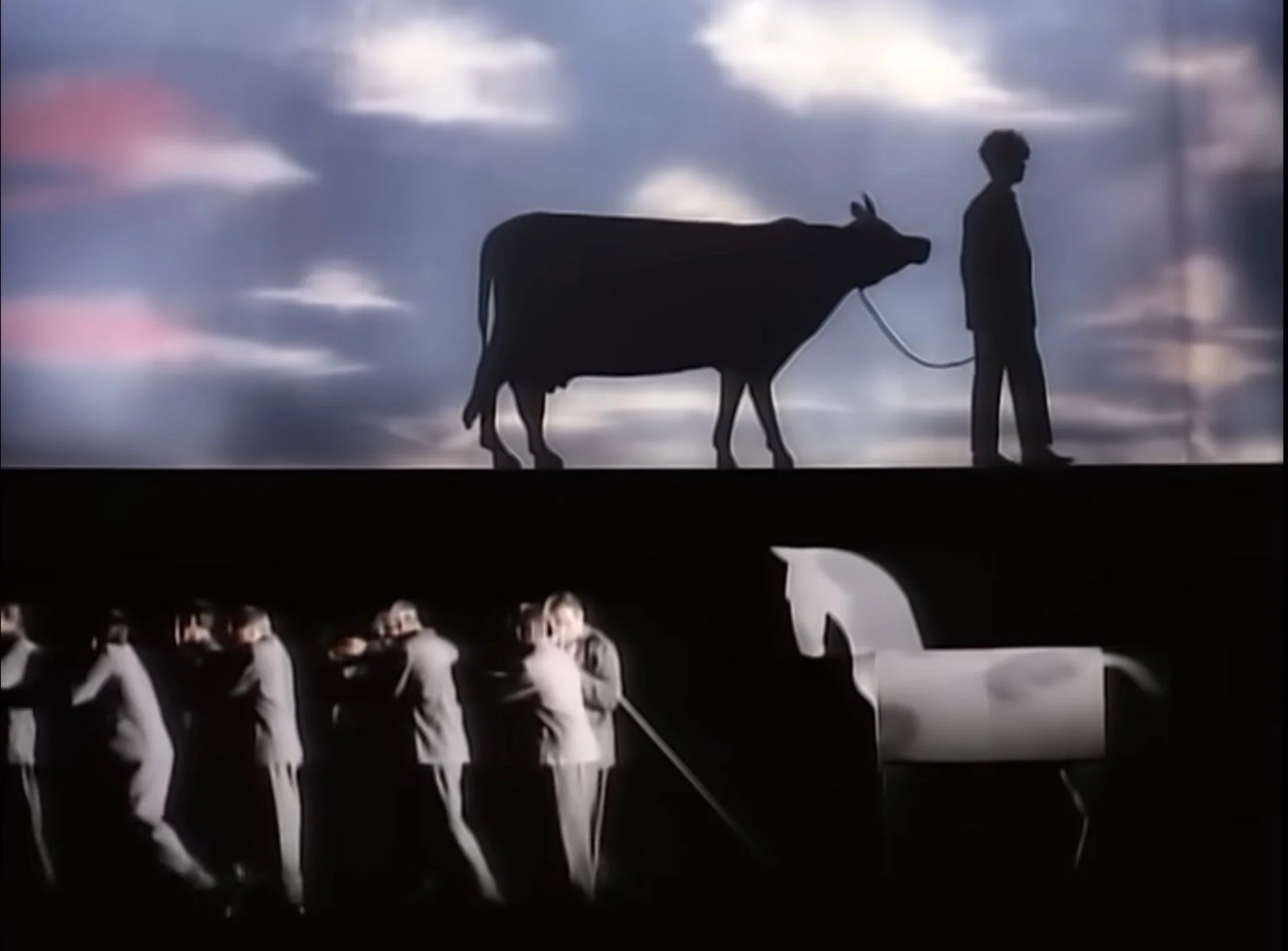

Echo & the Bunnymen's "Bring On The Dancing Horses" is the perfect vehicle for the Art as Trojan Horse metaphor. The song's compelling rhythm and aesthetic allure act as the vessel, bypassing conscious defenses to deliver its cargo: deep ideas, surging passions, and the inspiration that compels action. Now this Trojan Horse could be used for an extra 5% for taxation,

Art has always carried ideas into private spaces like a Trojan Horse. It slips past defenses and changes minds, one viewer at a time. ARR inserts a second Trojan Horse inside the first. It carries financial disclosure, tax events, and asset visibility into the same spaces where ambiguity once thrived. Some will welcome this. Others will resist it. Everyone in the art ecosystem will be forced to adapt.

ARR may help artists in certain circumstances. It may harm them in others. It may strengthen the market, or it may compress it. What is certain is that ARR changes the very identity of art within a modern economy. A painting becomes both an act of human expression and a permanent ledger entry that follows its owners wherever it goes.

This is a new era for art. The question is whether this era strengthens culture or slowly transforms it into an industry where every canvas carries not only a vision, but a paper trail.